Ken Grant Managing Partner, Senior Wealth Advisor

“Compound interest is the eighth wonder of the world. He who understands it, earns it…he who doesn’t…pays it.” – Albert Einstein

What’s the big deal about compound interest, and why is it important enough for someone like Einstein to famously comment on it?

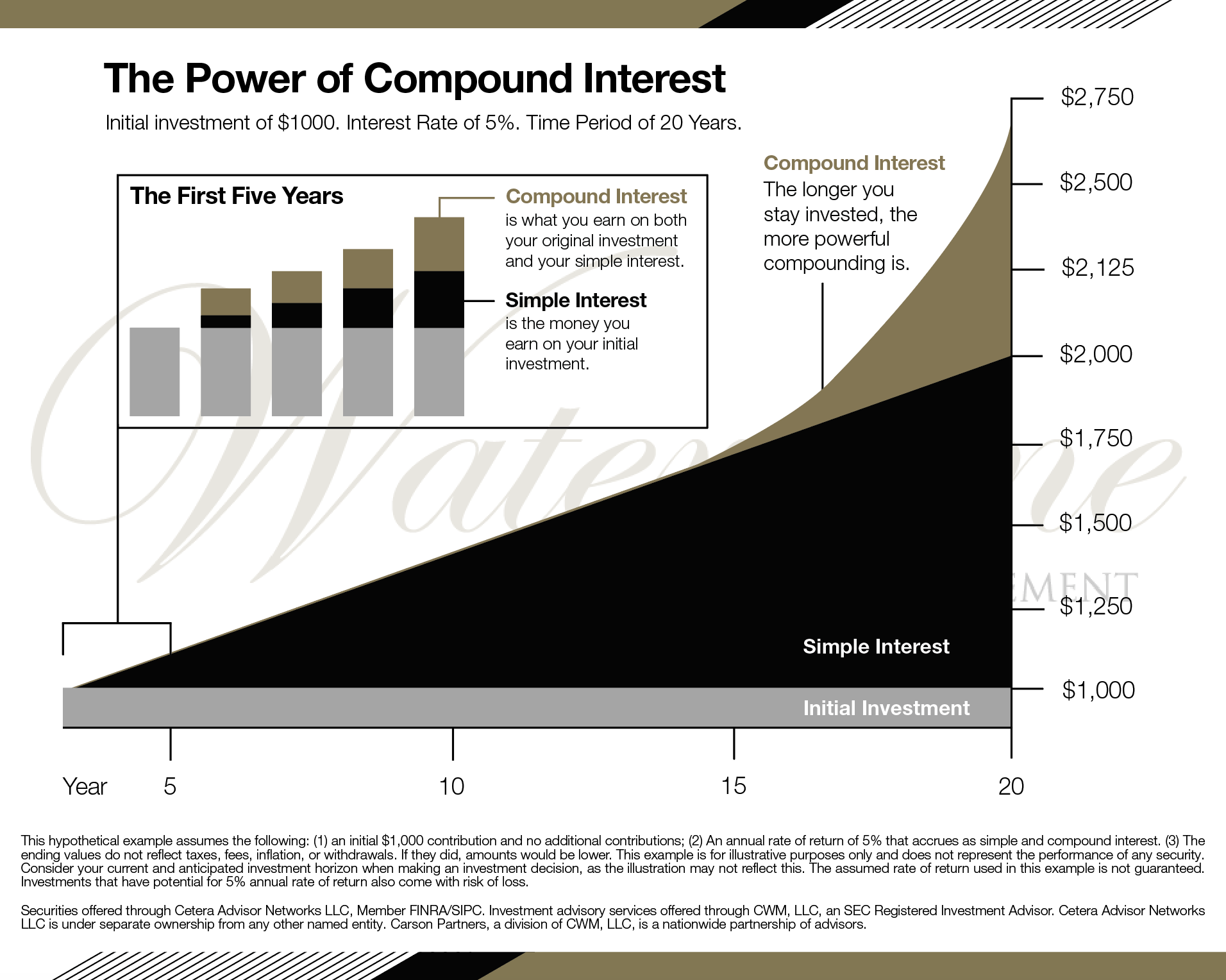

Simply put, compound interest is the interest you earn on the interest you’ve earned. It’s how money makes money, and the results can be astounding. Suppose you initially deposit $1000 and don’t add any more money to the account. If the funds grow at a 5% estimated rate of return, by the end of Year One, your account will be worth $1051, having earned $51 in interest.

But that’s not compound interest – that’s simple interest. It’s when you start earning interest on that simple interest that things get interesting. With that same initial investment of $1000 that has grown to $1051, year two allows the simple interest to start compounding, and the balance grows to $1105.

By Year Three, the balance is $1161, thanks to compound interest. And if that money stays put and simply earns interest for 10 years, the balance grows to $1647. In 20 years, the balance more than doubles to $2713 – without you adding a single dollar to the balance.

This certainly isn’t to say that you should invest some money and then never add more to your investments, but rather to show that compound interest can be a powerful tool in your financial arsenal.

Compound interest can be a double-edged sword.

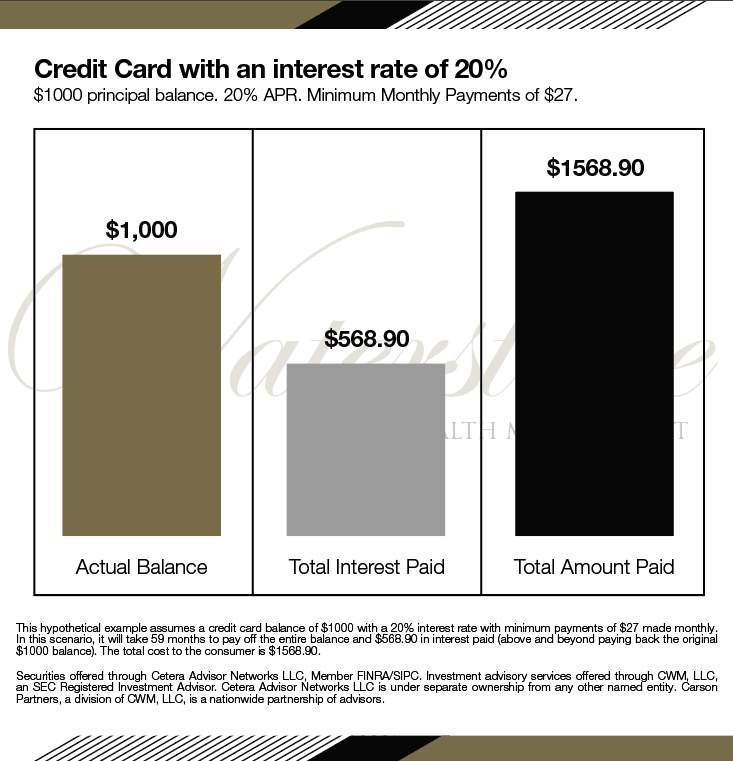

Just as compound interest is a positive force for investors, it’s a potentially negative force for debtors. The same principles of compound interest that earn investors money also cost those who carry credit balances from month to month. That’s because you’re charged interest on the balance you carry and that interest becomes part of your balance. The next statement cycle, you’re charged interest on the new balance – including the interest from the previous statement cycle – meaning, you’re paying interest on the interest you were charged.

If you carry a balance and only make minimum payments, compound interest works to the advantage of the creditor.

Suppose you have a credit card balance of $1000 with an interest rate of 20%. Every month, you make the minimum payment of $27. Though you’re vigilant about paying on time to avoid fees or an interest rate increase, without charging anything else to the card, it will take you 59 months to pay off the balance completely.

In those 59 months, you’ll pay a total of $568.90 in interest alone. That’s why Einstein said that those who don’t understand compound interest wind up paying it instead of earning it.

How do I make compound interest work for me?

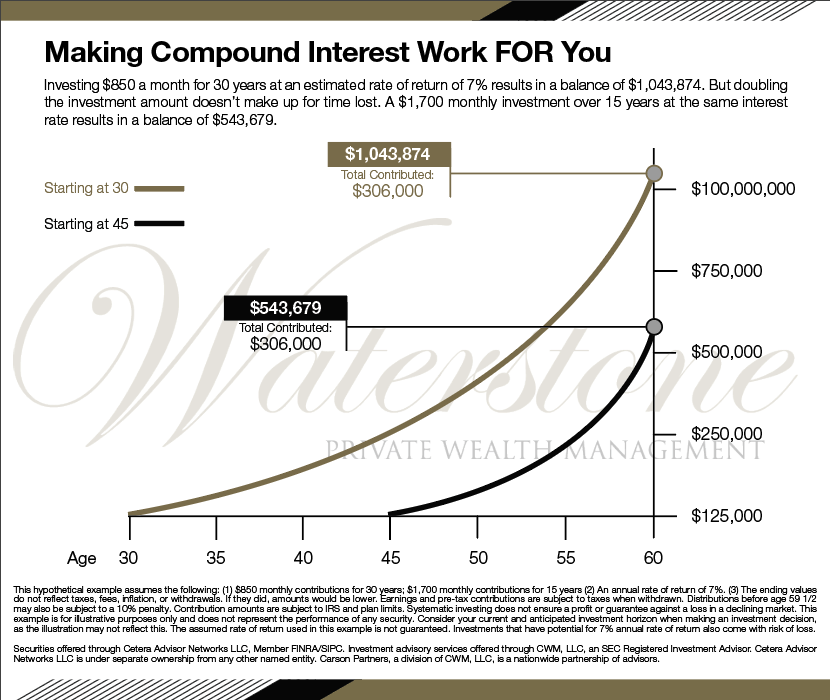

Time is an important aspect of compound interest. The longer the money earns interest, the more it can compound. So even if retirement feels distant, starting to save for retirement early in your career will yield substantial benefits.

Starting early can have a bigger impact than investing a larger amount later in life. For example, A 30-year-old investing $850 a month for 30 years at an estimated rate of return of 7% results in a balance of $1,043,874 at age 60. But a 45-year-old doubling the investment amount doesn’t make up for time lost. A $1700 monthly investment over 15 years at the same interest rate results in a balance of $543,679 at age 60.

The lesson: Invest early and often.

Compound interest puts time on your side as an investor (not as a debtor) and allows you to earn money on the money you earned. That’s why some people refer to compound interest as “magic” – it quietly builds wealth exponentially.

How do you play “catch up” with compound interest?

If you didn’t start your investing journey early, there are still things you can do to try to catch up and ready yourself for retirement. Increase your investing and lower your debt. If applicable, take advantage of catch-up contribution limits for people over the age of 50. Talk to your wealth advisor about other strategies to help your money grow.

Even if you missed out on years of taking advantage of compound interest, all is not lost. There are still steps that can be taken and strategies that can be employed to get you on the right track.