The Retirement Planning Concierge Resources

Providing this type of all-inclusive service is not common in the retirement planning industry. This approach to retirement planning and high touch service aims to assist you with every detail with less stress and hassle. So that you can get it right the first time, and move on into the retirement phase of your life having confidence that you made decisions that best align with your retirement goals.

FREE GUIDES:

Living in Retirement

Making the most of your years in retirement also requires a sense of financial well-being—the knowledge that you won’t outlive your assets or create a financial burden for children or other loved ones. In this guide, learn how to minimize risk factors, the three stages of spending and what you can do to reduce your financial stress and anxiety.

The (True) Cost of Investing: Why Fee Transparency is Critical to Determining Underlying Investment Value

While investment fees and expenses are required to be disclosed through investment prospectuses, layers of complexity, financial jargon and “hidden” fees can make it difficult for investors to understand the true underlying investment costs and the impact expenses have on their investment returns.

The Family Budget: Financial Empowerment at Your Fingertips

Managing family finances has become more complex than ever as the economy, job market and family structures have all undergone dramatic changes in recent years. American families continue to evolve at a rapid pace, resulting in new and complex financial concerns and challenges. When is the last time you sat down to review your family budget? Read this free guide for important tips on budgeting, savings and insurance.

Social Security: Maximizing Social Security Benefits & Minimize Tax Burden

Electing to receive Social Security benefits at early retirement age may result in higher personal income taxes and a smaller nest egg, particularly for high net worth individuals. In this free guide, we’ll shed light on common Social Security myths and provide options that, in certain instances, could decrease your payments to Uncle Sam and increase the financial legacy you leave.

Back 2 Basics

The good news is that American households have a total net worth of $85.2 trillion. The bad news is that most families are still behind where they were financially in 2007. In a recent survey, over half of Americans said they had less than $1,000 in their checking and savings accounts combined.

Estate Planning Simplified

Often, people believe that estate planning only benefits the very wealthy, but nothing could be further from the truth. It’s something everyone needs to engage in regardless of age, estate size or marital status. If you have a bank account, investments, a car, home or other property—you have an estate.

BLOG ARTICLES:

The Retirement Crisis

After a lifetime of hard work, people feel they should be able to live out their golden years with financial independence. Unfortunately for many, failing to plan means planning to fail.

Long Term Care Insurance: To Buy or Not To Buy…that is the question.

There comes a time when you must talk about the elephant in the living room. For many retirees, this elephant is the topic of long term care. Often when I initially bring this possibility up with my…

The Million Dollar Question: Do you have enough money to retire?

Do you have enough money to retire? It’s not a one size fits all answer. Do you really need $1 million to retire? Or is it $2 million for a retired couple? Or is it 10 times your current annual salary? All of these are nice, neat figures you might have heard.

Helping Create the Retirement of your Dreams

My retirees aren’t sitting around in their rocking chairs! The retirement bucket lists of today are full of the hopes and dreams that have finally come to fruition. Through sacrificing, saving, and careful planning and investing these folks have reached their goals and are reaping the benefits.

So tell me, what’s on your bucket list?

What’s on Your Bucket List? Ensuring your finances are aligned with your life goals can be complex and time consuming. I’ve heard every reason in the book as to why folks put it off. Mostly, people find it kind of scary and overwhelming so they avoid it like they avoid a root canal. Our goal is to take the uncertainty out of the equation.

Estate Planning 101 – Securing Accounts and Supporting Loved Ones

One of the most rewarding parts of my work is building relationships with clients that last through all stages of life. Clients often come to us when they are beginning to think about their retirement; many of our client relationships last all the way to end of life arrangements.

PODCASTS:

VIDEOS:

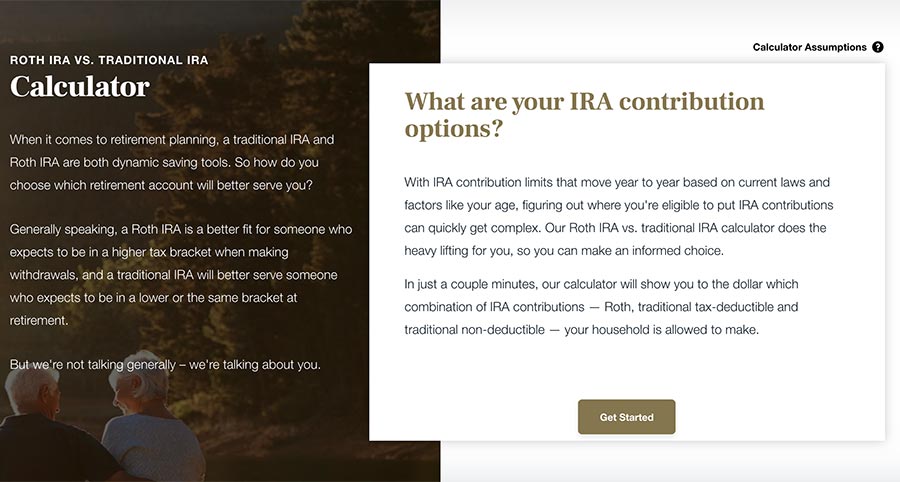

TOOLS:

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

Securities offered through Cetera Advisor Networks LLC, Member FINRA/SIPC. Investment advisory services offered through CWM, LLC, an SEC Registered Investment Advisor. Cetera Advisor Networks LLC is under separate ownership from any other named entity. Carson Partners, a division of CWM, LLC, is a nationwide partnership of advisors.

Individuals affiliated with Cetera firms are either Registered Representatives who offer only brokerage services and receive transaction-based compensation (commissions), Investment Adviser Representatives who offer only investment advisory services and receive fees based on assets, or both Registered Representatives and Investment Adviser Representatives, who can offer both types of services.

Privacy Policy | Important Disclosures | Cetera Advisor Networks Business Continuity Plan

This site is published for residents of the United States only. Registered Representatives of Cetera Advisor Networks LLC may only conduct business with residents of the states and/or jurisdictions in which they are properly registered. Not all of the products and services referenced on this site may be available in every state and through every advisor listed. For additional information please contact the advisor(s) listed on the site, visit the Cetera Advisor Networks LLC site at www.ceteraadvisornetworks.com.

Copyright 2020 CWM, LLC. All rights reserved. This content cannot be copied without express written consent of CWM, LLC. Wealth Designed. Life Defined. is a registered trademark of CWM, LLC and may not be duplicated.

Additional information about CWM, LLC and our advisors is also available online at www.adviserinfo.sec.gov or https://brokercheck.finra.org/. You can view our firm’s information on this website by searching for CWM, LLC or by our CRD number 155344.

Carson Privacy Policy | Terms of Use | Website Privacy Policy